when will capital gains tax increase be effective

It is expected that the long-term capital gains tax rate change will be effective the day it is agreed to and announced with little to no advance warning The current estimate of that effective date ranges from October 15 2021 on the early. This is a total of 1124000 additional tax.

Capital gains tax rates on most assets held for less than a year correspond to.

. For example if the stock continued to accrue 10 percent per year and then was sold after 10 years the effective return after paying capital gains taxes would be 78 percent while the after-tax. Bidens Capital Gains Proposal. Short-term capital gains are taxed as ordinary income period.

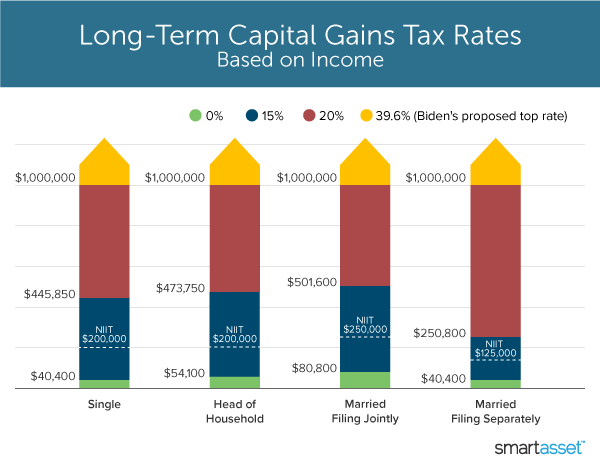

Although they are taxed separately the rate depends on your ordinary tax bracket. But the Biden administration has proposed an increase to a top rate of 396 on long-term capital gains and qualified dividends for those with over 1 million in income. Will capital gains tax increase in 2022.

14 and 15 appear to be the most likely proposed effective dates revenue raisers are likely to be. On Friday May 28 2021 the Biden Administration released its Green Book setting out the Presidents revenue and policy proposals. The actual day of announcement for a capital gains change will be a closely guarded secret beforehand as members and staff will want to avoid a market-moving leak.

Beyond that you will pay the highest LTCG rate of 20. Only 50 percent of realized capital gains are included in taxable income so that the effective personal tax rate on gains is half that of other income. If your winnings push you into the 25 28 33 or 35 tax bracket you will pay 15 on the winnings.

While the system works well for dividends it does not for capital gains. By contrast the other proposals in the Greenbook generally state that they will be effective. Taxpayers may claim a lifetime exemption from tax on realized gains up to 883384 on farm properties and small business shares and gains on principal residences are entirely exempt.

Democratic lawmakers have quietly begun discussing whether to make a proposed increase in the individual capital gains rate effective on the date the proposal is introduced. President Joe Biden proposed a top federal tax rate of 396 on long-term capital gains and qualified dividends. Effective Date Considerations KPMG Catching Up on Capitol Hill Podcast Episode 13-2021 Its not just the how much the capital gains tax rate may increase its the when.

Appendix Top 2020 marginal tax rates for capital gains and dividends The following table illustrates the current top marginal tax rate on capital gains by provinceterritory as well as the potential top marginal tax rate on capital gains if the inclusion rate increases to 66 2 3 or 75. The table also shows the inclusion Eligible. Dems eye pre-emptive capital gains effective date.

To increase their effective tax rate to 20 percent the household must remit an additional 12 million in tax 3 million in taxes paid with a 15 million income inclusive of unrealized gains. Individual tax rates are proposed by the House to increase from 37 percent to 396 percent. The effective date for this increase would be September 13 2021.

The effective tax rate on gains has fallen over time beginning with the 2000 reform that reduced the capital gains inclusion rate to 50 per cent from 75 per cent and continuing over time as corporate tax rate reductions have made gains even more tax-advantaged. Of particular interest to investors is the administrations proposal to raise the tax on long-term capital gains from its current maximum rate of 238 percent including the 38 percent net investment income tax to a new rate of 408. An immediate effective date would prevent taxpayers from selling assets and engaging in transactions ahead of the rate.

Now when their deferral period ends in 2026 and they have to pay tax at that point theyre paying tax. Dems eye pre-emptive capital gains effective date. When including unrealized capital gains as income the households effective tax rate is 12 percent below the proposed 20 percent minimum.

The announcement is likely to come after markets close before one of the mark-up days. The proposal would be effective for gains recognized after the undefined date of announcement which could be interpreted as the April 28 2021 date of the release of the American Families Plan or the May 28 2021 date of the release of the Greenbook itself. In somewhat of a surprise the budget request assumes that the proposed capital-gains-related changes would be enacted retroactive.

The proposal would increase the maximum stated capital gain rate from 20 to 25. With average state taxes and a 38 federal surtax the wealthiest people would pay. In his budget plan released May 28 Biden proposed making the capital gains tax changes retroactive to April 2021 in order to prevent wealthy taxpayers from quickly selling off assets to avoid the.

Additionally the proposal would impose a 3 surtax on modified adjusted gross income over 5000000 effective after December 31 2021. Should the proposals become law your client will now pay federal capital gains tax of 740000 in 2021 and 792000 in 2022 and 2023. Lets say hypothetically somebody invested in a qualified opportunity fund last year in 2020 when the capital gains tax rate was down at 20.

In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for more than a year. Do capital gains increase taxable income.

What S In Biden S Capital Gains Tax Plan Smartasset

Double Taxation Definition Taxedu Tax Foundation

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

What S In Biden S Capital Gains Tax Plan Smartasset

2022 Trust Tax Rates And Exemptions Smartasset

Capital Gains Yield Cgy Formula Calculation Example And Guide

Capital Gains Tax Spreadsheet Australia Budget Spreadsheet Excel Spreadsheets Templates Spreadsheet Template

Sales Taxes In The United States Wikipedia The Free Encyclopedia Capital Gains Tax Sales Tax Tax

Income Types Not Subject To Social Security Tax Earn More Efficiently

How Might The Taxation Of Capital Gains Be Improved Tax Policy Center

Irs Tax Brackets 2022 What Are The Capital Gains Tax Rate Thresholds Marca

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

How Roth Ira Conversions Can Escalate Capital Gains Taxes Financial Planning Capital Gains Tax Capital Gain Roth Ira Conversion

The Capital Gains Tax And Inflation Econofact

2022 And 2021 Capital Gains Tax Rates Smartasset

2022 And 2021 Capital Gains Tax Rates Smartasset